4 Key Elements of Estate Preparation 6 Estate Preparation Must-Haves Benefits of a QTIP Trust QTIP Trusts Terminable Rate Of Interest Regulation and also Legal Meaning How Much do California Attorney Expense? The Taboo Concern for Count On as well as Will

Estate planning equips several advantages for those people with substantial wealth and also assets to their name. When done well, it can provide a great possibility for pairs to lower and even eliminate their estate's tax obligation problem. This allows for the complete tax burden to be heavily mitigated by those employing it at a later day.

For additional assurance as well as comfort, ensure that he is accredited as a specialist in estate, depend on, as well as probate planning law in the state in which you live. The most professional family members depend on lawyer need to have considerable knowledge of this area of regulation in his state. A wonderful household estate attorney is one that only concentrates on estate planning. Due to the fact that these specialized legal representatives must additionally have years of experience and proceeding education and learning committed to this area, they are more likely to be totally well-informed regarding the laws in your state. If they are not well-versed and approximately day on estate legislations, your estate strategy might not be authorized by the courts after you die.

It's likewise regarding ensuring your family members and other recipients are provided for and have access to your assets upon your temporary or irreversible incapacity. If you become incapacitated while still to life, Estate planning also includes providing permission to family participants or an attorney to bring out your desires. A trust is a legal entity that can have your properties (while living or at fatality) and also be managed based on your wishes detailed in the legal document that created the entity. For instance, a depend on would permit you to determine exactly how you wanted your youngster to benefit from your properties throughout their life. Some on-line sources such as LegalZoom can be appropriate if you are single.

Estate Attorney Can Help Figure Out Complex Family or Monetary Scenarios

- Developing an authorities and also legislated plan ensures that your yearn for the circulation of your possessions are carried out.

- Even if the attorney has all of the right qualifications, you still need to establish if you can see yourself functioning very closely with him.

- Trust funds can be established as care systems for the elderly, routine earnings for offspring, or to be used for sure expenditures or circumstances.

All states control attorney marketing, so just ads that pass the rigorous examination of the state bar association are enabled. This makes sure that the lawyer isn't making false insurance claims or promising unattainable outcomes. Be certain to bring it up with your advisor if your advisor hasn't came close to the subject of http://troyrcwc782.bearsfanteamshop.com/6-estate-planning-must-haves estate preparation with you. Also, proceed as well as ask your advisor who did his/her own individual estate plan-- the solution might be simply that you're searching for.

What is considered senior abuse?

Family trusts are designed to protect our assets and benefit members of our family beyond our lifetime. When our assets are in a family trust we no longer have legal ownership of them – the assets are owned by the trustees, for the benefit of our family members.

Estate Lawyers Are Needed Because State Laws Regulation Estate Program

A level cost may cover the prep work of fundamental files and also preliminary examination. If an attorney intends to bill you by the hour, attempt to discuss a flat fee for all the job you expect to do.

What questions should you ask a probate lawyer?

Answer questions. Avoid volunteering information unless an attorney asks for it directly. Answer each question honestly and completely, and avoid saying anything else. You do not need to talk for five minutes after each question. If a simple yes or no would suffice, then that is all you need to say.

6 Estate Preparation Must-Haves

Real Estate Situated Outside of Your State.

Ahealthcare power of attorney (HCPA) marks one more individual (generally a partner or relative) to make vital medical care choices in your place in case of inability. This is why it is very important to keep a recipient-- and a contingent beneficiary-- on such an account.

If you've avoided estate planning, take these actions to protect your family. An irreversible trust fund is typically chosen over a revocable depend on if your main aim is to lower the quantity subject to inheritance tax by efficiently eliminating the depend on properties from your estate.

Avoiding Probate.

Here are some variables to take into consideration when deciding if you require a Revocable Living Count on as opposed to simply a will. Several elder law attorneys concentrate on estate preparation and also can aid you navigate with the choices and also the tax obligation effects of managing and also resolving your estate. A living trust fund is an option for estate planning that can be extremely eye-catching. After your death, the assets are distributed to your beneficiaries according to your desires as well as on any type of routine you pick. As a lawyer, one can give a remarkable amount of economic and also psychological stability to a pair as they prepare for the secure as well as safe circulation of their properties to their partner and also picked recipients after their fatality.

- The function of a revocable living trustis to commit to writing a legal record that will profit you throughout your lifetime along with your successors because your properties will certainly be safely held within it.

- We also suggest that our clients do multigenerational preparation by http://gregoryoaly196.tearosediner.net/recognizing-the-differences-between-a-will-as-well-as-a-depend-on assisting their kids begin estate strategies, for instance, when they remain in their 30s with little ones.

- A legal record called a 'trust deed' will formally establish the family members depend on.

What makes a good estate planning attorney?

While a QTIP does offer more overall direction of the funds, a marital gift trust has the flexibility of not mandating that the surviving spouse take annual allotments. Instead, they are able to leave principal in the trust if so desired, which may continue to increase the total assets through interest over time.

Estate Planning.

While portion charges are standard, this can be troublesome for smaller sized depends on. A count on holding $200,000 and paying a fee of 1.5% would pay an annual charge of $3,000, which might or might not cover the trustee's costs. For a depend on holding $200,000, for example, this would certainly entail an extra fee of $1.000 a year. Trustees are qualified to "practical" payment whether or not the count on explicitly offers such. Usually, specialist trustees, such as financial institutions, trust fund companies, as well as some law office, cost in between 1.0% and 1.5% of depend on possessions annually, depending in part on the dimension of the count on.

You possibly can not press criminal costs, yet based upon what you say you ought to have the ability to have the trustee eliminated and also changed by a person who follows out the responsibilities of trustee. I would take the depend a local trusts as well as estates attorney and clarify the situations. The idea of a "QTIP depend on" exists just for federal gift and also inheritance tax functions, and from a state legislation viewpoint, such a trust does not differ from any kind of various other trust other than that it should meet the requirements of the Internal Income Code. To assist, we published an overview on the five estate planning blunders you can not manage to make.

Do I need an attorney for estate planning?

A highly skilled trust attorney will be able to establish trusts for loved ones, minimize estate taxes, avoid probate, create wills, plan for disability, and much more. Or, if you have extensive real estate holdings, the ideal trust planning attorney will have a wealth of knowledge about real property law.

DIY Estate Planning

Without a trust, many jurisdictions limit your adaptability in this regard. Also, it is normally easier to make amendments to a revocable count on than to a will. A will certainly is one technique for passing an estate on to your recipients. Which strategy is ideal suited for you relies on your certain scenarios. Chances are a lawyer you've dealt with in establishing your organisation, purchasing your house, or examining a contract will know several competent estate planning attorneys in your area.

Power of Attorney: When You Required One.

For instance, staying clear of probate might be a considerable advantage if you own realty in more than one state, due to the fact that you avoid numerous probate procedures. Since each territory's probate procedure is different, it is necessary to seek advice from local advise to determine which, if any, disadvantages of probate relate to you. Creating a revocable count on is most likely the most effective method to make certain that your residential property stays offered to be used for your advantage, need to you come to be physically or psychologically incapable of managing your very own events.

An estate planning attorney is a kind of attorney who comprehends just how Helpful resources to encourage clients on obtaining their events in order to prepare for the opportunity of psychological impairment and ultimate fatality. They have years of mentoring, proceeding lawful education and learning, as well as experience.

What Is the Ordinary Expense to Prepare a Living Count On?

- A living trust fund is an option for estate preparation that can be extremely eye-catching.

- For instance, a spendthrift trust fund may be made use of to stop wasteful spending by a spendthrift youngster, or a special demands depend on might be used for developmentally disabled children or adults.

- An estate preparation attorney is a type of legal representative who comprehends just how to recommend clients on getting their events in order to prepare for the opportunity of mental disability and also ultimate death.

- If you intend to prevent legal charges or can not pay for an attorney, Nolo's Quicken WillMaker software application permits you to develop a personalized and also extensive estate prepare for your whole family members.

- Which strategy is best fit for you relies on your particular situations.

That indicates a court manages the management of the will and guarantees the will stands and also the home gets dispersed Have a peek at this website the way the deceased desired. A trust fund passes outside of probate, so a court does not need to oversee the procedure, which can conserve time and money. Unlike a will, which enters into the public document, a trust can remain exclusive. You might want to ask in advance if you're more comfortable with one way or another.

The owner of a life insurance policy can be changed to the trustee of the insured's revocable living depend on without suffering any type of revenue tax obligation consequences. Yet make certain you check with your estate preparing attorney prior to taking any action.

What to Look For in an Estate Planning Attorney

This may be difficult and may include various other expenses such as filing charges. While a trust fund may be moneyed upon the grantor's death, it is usually more suitable to money it while the grantor is living.

When executing estate preparation, your http://arthuroefj190.simplesite.com/445777951 goals are to ensure that your desires are met and that you receive the most security feasible, however you likewise wish to manage expenses. So if you're determining in between producing a will certainly or a living trust fund, expense can play a large function in your factor to consider. Among the key advantages of creating a revocable depend on is the capability to supply uninterrupted financial investment monitoring need to the grantor ended up being impaired, as well as after the grantor's fatality. Assuming the assets were formerly moved into the count on's name, there is no demand to reregister safeties after fatality.

How much does an estate planning lawyer charge?

If one or more of these situations apply to you, then you'll need the counseling and advice of an experienced estate planning attorney to create your estate planning documents. Otherwise, it may be a probate lawyer and your state's department of revenue and/or the IRS that will receive the largest chunk of your estate.

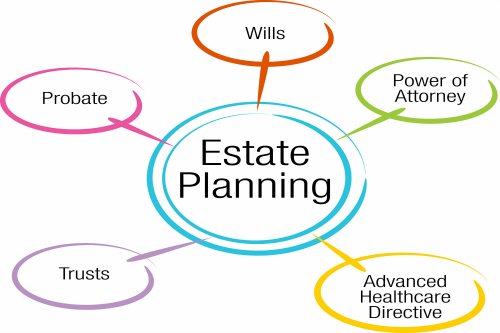

4 Key Elements of Estate Preparation

When performing estate planning, your objectives are to make sure that your dreams are satisfied and that you obtain one of the most protection feasible, but you additionally wish to manage prices. So if you're deciding between developing a will or a living count on, expenditure can play a huge role in your consideration. When you die, there is even more to estate planning than determining how to divvy up your properties. It's additionally concerning making sure your relative as well as other beneficiaries are attended to as well as have accessibility to your assets upon your irreversible or short-term inability.

If you discover on your own in this kind of scenario, a senior regulation attorney can assist determine your civil liberties as well as the best course of activity to seek visitation. Many areas of the regulation focus on a particular self-control, and also senior regulation attorneys focus on a specific type of person. Since of age, the major purpose of an older regulation lawyer is to assist aging Americans to lawfully navigate through the problems of life that develop merely. They can offer legal advice as well as therapy on getting ready for long-term care, picking retirement, planning and also settling your estate and a host of other issues that older Americans might face. As we go into retirement age, there are government benefits that might be offered to us, however determining if you receive the government programs can be tough to do alone.

An older law lawyer can aid you get Medicaid benefits and also plan efficiently. A count on is a legal entity that can possess your possessions (while living or at fatality) as well as be controlled based on your dreams outlined in the lawful document that produced the entity. For instance, a depend on would certainly allow you to determine how you wanted your youngster to benefit from your possessions throughout their life. Some on the internet resources such as LegalZoom can be appropriate if you are single.

The Conveniences and Shortcomings of Revocable Trusts.

When your life comes to be an extra complex-- a spouse, kids, a small business, monetary possessions-- it is usually a good suggestion to talk with an estate attorney. In lots of jurisdictions, wills http://emilioiiwk716.image-perth.org/for-how-long-does-an-administrator-of-a-will-have-to-settle-an-estate change instantly upon divorce, marital relationship or the birth of a kid.

The owner of a life insurance policy can be altered to the trustee of the insured's revocable living trust fund without enduring any earnings tax repercussions. But make certain you contact your estate intending lawyer prior to taking any kind of activity. Some states do not safeguard a person for creditor protection objectives when it comes to a revocable living depend on.

- To make the political election, the executor listings, on a routine affixed to the inheritance tax return, the properties that are to go into the QTIP trust.

- When one spouse passes away, it lets the survivor decide just how much (if any kind of) of the departed partner's residential or commercial property ought to be kept in trust to maximize estate tax savings-- helpful in these times of continual change and also uncertainty about the inheritance tax.

The quantity of your plan costs can rise based on your age, health or any preexisting conditions. An older law lawyer well versed in appropriate Medicaid preparation or estate planning can additionally help you make the most effective monetary arrangements for your long-lasting care. In order to have the ability to make use of Medicaid for nursing residence expenses, your application should be effectively sent to the state where you will certainly be living. It might call for substantial Medicaid planning-- which is lawfully positioning your earnings and also assets, so you can receive Medicaid. An effective Medicaid strategy will certainly allow you to obtain the advantages of the program, while having the ability to keep sufficient of your revenue or possessions to supply and also support your enduring partner or member of the family.

What documents do I need for estate planning?

There are four main elements of estate planning, which include drawing up a will, a living will and healthcare power of attorney, a financial power of attorney, and in some cases, a trust.

If the count on is moneyed prior to fatality, the property in the depend on remains in the trustee's name before as well as after the fatality and also is instantly available for liquidation should the requirement develop. Also after a guardian has actually been named, proceeded court guidance over the monitoring of investments as well as dispensations is normally called for. This can consist of yearly bond fees, annual accounts as well as extra lawful as well as bookkeeping costs.

What should you not put in a living trust?

Most areas of the law focus on a specific discipline, and elder law attorneys focus on a specific type of person. The main purpose of an elder law attorney is to help aging Americans to legally navigate through the issues of life that arise simply because of age.

Possessions That Do Not Belong in a Revocable Depend on.

If you have minor kids or are thinking about having youngsters, choosing a guardian is extremely vital and also in some cases ignored. See to it the specific or couple you select shares your views, is monetarily audio, and also is really happy to increase kids. Just like all designations, a backup or contingent guardian need to be called as well. Ahealthcare power of lawyer (HCPA) designates one more individual (generally a spouse or member of the family) to make important medical care choices on your behalf in the event of incapacity.

How Much Will a Legal Representative Charge to Write Your Will?

In case of death, you might be expected to have many conversations as well as dealings with making it through member of the family concerning the estate strategy. In order to succeed as an estate coordinator, you may require to walk a great line of being a shoulder to lean on and also http://jeffreydzye804.wpsuo.com/4-key-elements-of-estate-preparation the private depended on to interact estate preparation matters in a timely as well as professional way. Having a natural need to aid others can offer you well as you work to ease a family's challenging time. If you wish to avoid legal costs or can not afford a lawyer, Nolo's Quicken WillMaker software application allows you to create a customized and also extensive estate plan for your whole family. Attorneys generally charge far more for a living trust than for a will, although a basic living trust fund. is a relatively typical file, like a will.

A Lot More Lawful Subjects.

How much does an attorney charge for estate planning?

1, 2 and 3. The correct answer is d. Some accountants, investment advisors, financial planners, and others (such as insurance experts) are qualified to give estate planning advice.

Besides this, in some states probate is not needed to transfer ownership of a car after the owner dies. Certain states currently permit car owners to designate a beneficiary after fatality. Get in touch with your estate planning lawyer to comprehend just how to prevent probate of your vehicles in your state. Qualified retirement accounts, including 401( k) s, 403( b) s, IRAs, and qualified annuities, should not reside within your revocable living depend on.

- It might be feasible to gift several of your residential or commercial property during your life time and pass it on to those you pick after you pass on entirely tax free.

- An effective estate plan additionally consists of arrangements permitting your family members to gain access to or control your assets must you become unable to do so on your own.

- The old Latin saying, "Caution Emptor," or "Caveat emptor," certainly puts on estate preparation.

Durable financial power of lawyer.

You may have listened to that you require to make an "estate strategy," yet what does an estate strategy cover and exactly how do to make one? Here is a basic listing of the most crucial estate planning concerns to think about. Though the name overlaps with a last will as well as testament, a living will is really quite different. This is a paper that tells medical professionals, doctor, and also household which treatments you want if you're dying, permanently unconscious, or otherwise not able to choose concerning emergency treatment. It has absolutely nothing to do with age; grownups of all ages can benefit from having these wishes defined.

Likewise, go ahead and also ask your expert that did his or her own individual estate plan-- the answer may be just that you're trying to find. FindLaw.com offers an introduction of the info required to do estate preparation as well as a much more detailed estate preparation checklist that you can fill out.

For that reason, estate organizers benefit from being mathematically inclined. Throughout this time, your customer will rely on your work to assist guard his/her assets. You will likely be turned over to craft the plan that takes care of taxes, lines up with federal as well as local regulations, as well as passes one of the most riches to the beneficiaries upon death. You might likewise be put accountable of the production of any kind of linked count on funds to specific assets. A good estate plan should be updated on a regular basis as customers' economic scenarios, individual motivations, as well as federal and also state legislations all evolve.

What Is A Trust?

When you pass away, there is even more to estate preparation than choosing exactly how to divvy up your assets. It's additionally regarding making sure your member of the family as well as other beneficiaries are attended to and also have accessibility to your assets upon your long-term or temporary incapacity. As an example, a will certainly permits you to name a guardian for kids as well as to define funeral arrangements, while a trust fund does not. On the various other hand, a trust fund can be utilized to plan for impairment or to give cost savings on taxes.

Senior law lawyers are knowledgeable in all locations of government assistance readily available to senior citizens. Take care of your family members by making a will, power of attorney, living will, funeral arrangements, as well as more. State laws vary significantly in the location of counts on and also should be thought about prior to making any choices about a depend on. You can call yourself trustee (or co-trustee) and maintain ownership and control over the trust fund, its terms as well as assets during your lifetime, however make stipulations for a follower trustee to handle them in the event https://penzu.com/p/7cdf49b6 of your inability or fatality.

Power of Lawyer: When You Need One.

All lawyers are educated to have a standard functioning knowledge of the lawful system and also the ability to gain information on any element of the regulation. Yet if someone's technique mostly concentrates on an area far eliminated from your requirements, you may want to search for another person.

Most of the times, a household estate attorney offering per hour rates are possibly not acting in your best interest as he will certainly might be most likely to need lots of office appointments and numerous drafts of records to eventually increase his pay. The old Latin saying, "Caveat Emptor," or "Buyer Beware," absolutely applies to estate planning. Countless bucks will after that be spent by your loved ones dealing with a competent estate planning attorney after the reality to repair your blunders. Lots of estate legal representatives look to accountants for aid with estate, trust, and also revenue tax problems. Therefore, opportunities are your accountant can recommend one or more estate planning attorneys in your area to create your estate plan.

- An elder legislation attorney well versed in correct Medicaid planning or estate preparation can also aid you make the most effective economic arrangements for your lasting treatment.

- There are waiting durations that have to be satisfied in order to shield the properties.

With a living trust fund, you can be the trustee-- the manager of the assets-- and likewise keep the power to make any changes you intend to the trust fund. You can relocate properties in or out of it-- or perhaps terminate the trust completely. Living counts on are a preferred option due to the fact that, unlike with a will, the assets in the count on do not have to go via probate after your fatality. When carrying out estate planning, your goals are to make sure that your desires are met which you receive the most defense feasible, but you also want to take care of expenses.

With Quicken WillMaker & Count on you can lastly deal with your estate plan-- from house. Without the best estate preparation, your partner can be omitted in the cold.

Who should have Trusts?

The firm charges $500 for an initial, in-person consultation. The client has no commitment to pay anything beyond that unless the firm and the client agree on what work needs to be done and what the charge will be.

The fact that absolutely nothing has actually been distributed in 3 years, including the supply which should not be complicated, feels like evidence that your brother is not functioning effectively and should receive a lower instead of a better cost. There's also the issue of whether he ought to be paying rent for staying in your house. While I make sure you don't want to spend great cash after bad, you might need to work with guidance to see to it your civil liberties are represented. My brother is its providing my moms estate which includes 500k in real estate and also 400 in supplies left in trust. He's declaring he can take a 3% cost on all, as an estate/trust executor. recent article released internet by Wide range Consultant reports on a study of the fees charged by national depend on firms which follow the details over.

What is a Common Trustee Charge?

Everybody has actually heard the terms "will certainly" and "depend on," yet not everyone understands the distinctions between both. Both work estate preparation tools that serve various objectives, as well as both can interact to create a total estate strategy.

Will vs. Trust fund: What's the Distinction?

Essential End-of-Life Papers for Seniors.

This list is really just a starting factor and doesn't even attempt to address the vast quantity of info you can discover concerning professionals, consisting of estate legal representatives, on the internet. Sometimes, however, excessive info is just that, and so you need to stick with some standard techniques.

The term describes the circulation of the estate's last properties, which generally implies that the Administrator has lacked points to do. A count on fund is a lawful entity that holds and also takes care of assets in behalf of an additional private or entity. A testamentary count on is a lawful entity that handles the assets of a deceased person according to instructions in the individual's will. Trust funds supply more control of possessions, but they are more costly, can be tiresome to set up, and also must be actively taken care of.

We make it easy for you to comprehend The Probate Process so you can make the most effective decisions on your own and your family. It is very important to compose a long lasting power of attorney (POA), so an agent or a person you designate will certainly act upon your behalf when you are unable to do so yourself. Lacking a power of attorney, a court may be entrusted to decide what takes place to your possessions if you are located to be mentally incompetent, and also the court's decision might not be what you desired.

Talk with a Probate attorney.

Throughout this procedure of creating an individualized strategy together, he must see to it that you extensively recognize its certain details. Lots of legal representatives, including estate lawyers, promote through numerous methods, consisting of in print, on the radio or on TV. All states manage attorney advertising, so just ads that pass the strict examination of the state bar association are permitted. This makes sure that the attorney isn't making incorrect claims or appealing unattainable results.

A will or trust fund ought to be among the main components of every estate plan, also if you don't have significant possessions. Wills make sure home is distributed according to a person's desires (if composed according to state legislations). Possession security planninghas become a substantial reason lots of people, including those who currently have an estate strategy, are consulting with their estate intending lawyer. Once you believe or understand that a claim is on the horizon, it's far too late to put a plan in position to protect your assets. Rather, you require to begin with an audio economic plan and pair that with a thorough estate plan that will, subsequently, safeguard your possessions for the advantage of both you throughout your life time and also your beneficiaries after your death.

- Similarly, in almost all states, you can register your stocks, bonds, or broker agent accounts to move to your beneficiary upon your death.

- Go over the value of wills and also estate preparation, including preparation for a minor or grown-up with special demands, probate process, as well as various other issues.

A will or trust must be composed in a way that is consistent with the means you've bestowed the possessions that pass outside of the will. In addition to that both people might come to be bitter towards each various other (and you) throughout a legal fight. Without the appropriate preparation and files, court of probate might result in unintended distribution of properties.

What is the average cost of an elder law attorney?

Closing an Estate. Though you hear the term consistently, there is no such thing as Closing an Estate. The term refers to the distribution of the estate's final assets, which typically means that the Executor has run out of things to do.

And also in those states, lawyers are not needed by legislation to gather a percent cost. You can and should attempt to negotiate a hourly price or level fee with the lawyer. Yet many lawyers choose the "statutory charge" due to the fact that it's generally extremely high in connection with the amount of job they have to do.

How do I prepare an estate plan?

Estate law attorneys earned a reported median annual salary of $64,054 in 2011. Self-employed individuals who worked in estate planning had the highest earning potential, making a yearly median wage of $95,000. Another highly paid specialization was estate law attorneys who worked for a foundation or trust.

A Quick Overview to High-Net-Worth Estate Preparation.

The lawyer ought to likewise guarantee that you full formation records for a revocable living count on. When you die, make sure to notify your depend on intending lawyer that you want a living depend on that stays clear of probate. Prior to starting the estate planning process, you want to make sure that the attorney you are working with is charging you a set price for every one of the work that he is doing. A flat upfront charge will ensure that there will certainly not be any type of shock costs since you will know the specific cost of http://eduardolckl038.simplesite.com/445651141 the services ahead of time. As long as you know what the flat cost does and also doesn't cover, you should not come across covert costs.

How to Find an Estate Planning Attorney

When carrying out estate preparation, your objectives are to guarantee that your dreams are fulfilled which you receive the most security feasible, yet you likewise want to manage costs. So if you're choosing in between developing a will certainly or a living trust, cost can play a big function in your factor to consider. When you pass away, there is more to estate preparation than making a decision how to divvy up your properties. It's likewise concerning making certain your member of the family and various other recipients are offered and have access to your possessions upon your permanent or short-lived incapacity.

A QTIP trust does not receive the inheritance tax marital reduction under standard tax guidelines due to its restrictive nature. Nonetheless, the tax obligation code now allows your Administrator to assert the marriage deduction for quantities moved to a QTIP trust by making a political election on your estate tax return. In its most basic kind, a QTIP trust fund is essentially an A/B trust setup that is much more restrictive than a normal marriage trust fund. In the majority of A/B count on arrangements, the marital, or A portion of the trust fund, is completely easily accessible by the making it through spouse.

Please consult your individual advisor to identify whether this details might be proper for you. This information is supplied only for understanding into our general management philosophy and procedure.

A checklist to aid you deal with your family members by making a will, power of attorney, living will, funeral plans, and extra.

Elder legislation attorneys are knowledgeable in all areas of entitlement program readily available to senior citizens. It has ended up being a specialty arm of the lawful occupation since the Great post to read typical lifetime as well as the variety of seniors remains to raise.

Upon the fatality of your surviving partner, the depend on is dispersed according to your ultimate requirements. Predicting how much an individual will certainly contend his or her death and also how much will certainly undergo government inheritance tax is very challenging. Included in the mix is the unpredictability of life itself-- which spouse will outlive the other, will he or she remarry, and also other significant life issues. The QTIP count on additionally supplies versatility to your Administrator in optimizing your government inheritance tax savings.

- To make the political election, the executor listings, on a schedule connected to the estate tax return, the properties that are to enter into the QTIP trust fund.

- An effective estate plan also includes provisions enabling your relative to accessibility or manage your assets need to you become incapable to do so on your own.

- When one partner passes away, it lets the survivor decide how much (if any kind of) of the deceased partner's residential property should be kept in trust to optimize inheritance tax cost savings-- helpful in these times of continuous adjustment and also unpredictability concerning the inheritance tax.

A trust passes outside of probate, so a court does not require to look after the procedure, which can save money and time. Unlike a will, which becomes part of the general public record, a trust fund can stay personal.

As constantly, get in touch with your Discover more here estate intending lawyer to recognize each of these private matters. Buy the time currently to comprehend what you're dealing with to avoid prospective disaster in the future. Estate preparation is the preparation of tasks that offer to manage a person's possession base in the event of their incapacitation or death. An irreversible trust can not be changed, amended or terminated without the permission of the grantor's named recipient or recipients.

What should you not put in a living trust?

Most areas of the law focus on a specific discipline, and elder law attorneys focus on a specific type of person. The main purpose of an elder law attorney is to help aging http://remingtonaeal032.huicopper.com/12-simple-steps-to-an-estate-strategy Americans to legally navigate through the issues of life that arise simply because of age.

Power of Lawyer: When You Need One.

Thinking the assets were previously moved into the count on's name, there is no need to reregister protections after fatality. On top of that, relying on the cash money needs and also financial investment objectives of the grantor's estate, there may be no requirement to create a new financial investment technique. The avoidance of probate is often mentioned as one of the primary benefits of a revocable trust because probate can be costly and also time consuming.

Estate Planning Attorney

The National Legislation Testimonial is a totally free to utilize, no-log in data source of lawful and business short articles. The material and web links on meant for general details functions only.

Feel complimentary to call us to set up a totally free appointment if you have any concerns concerning Closing an Estate or The Probate Refine. We have actually seen it all, as well as this experience allows us to describe complex estate regulation as well as Probate methods plainly and also concisely.

Because the estate never shut; it just ran out of things to do, the executor still has this power. Though you listen to the term continually, there is no such thing as Closing an Estate. Probate instructions never ever inform you how to "Shut the Estate," because it never really takes place.

Lawful Disclaimer.

Throughout this process of producing a personalized strategy together, he should ensure that you completely recognize its particular information. Lots of legal representatives, including estate attorneys, advertise with various methods, including in print, on the radio or on TV. All states regulate lawyer marketing, so just advertisements that pass the rigorous analysis of the state bar association are enabled. This guarantees that the attorney isn't making incorrect claims or appealing unattainable results.

A will certainly or trust needs to be among the primary components of every estate strategy, even if you do not have considerable assets. Wills ensure residential property is dispersed according to a person's dreams (if prepared according to state regulations). Possession security planninghas come to be a substantial reason why lots of people, including those who currently have an estate plan, are meeting with their estate intending attorney. As soon as you recognize or believe that a suit is on the horizon, it's far too late to put a plan in place to protect your properties. Instead, you require to begin with an audio monetary strategy as well as couple that with an extensive estate plan that will, in turn, protect your properties for the advantage of both you during your life time as well as your recipients after your fatality.

- The substantial loss of one's estate to the payment of state andfederal estate taxesor stateinheritance taxesis a great incentive for lots of people to put an estate plan with each other.

- Furthermore, https://drive.google.com/drive/folders/1gejF1WUzV6j4N3r1zv--5BOPPyCIwo_h?usp=sharing in almost all states, you can register your stocks, bonds, or brokerage accounts to transfer to your beneficiary upon your death.

- Talk about the significance of wills and also estate planning, consisting of planning for a adult or small with special needs, probate process, and also other issues.

A common misconception is that just rich people should prepare files for medical regulations, wills, depends on, and also guardianship, however this myth could not be better from the fact. Regardless of the individual, in order to create a wonderful estate plan you require a knowledgeable family members depend on attorney who entirely comprehends your situation and distinct desires. At Intrepid Law, experienced attorney Adam Tucker really embodies the high qualities of a greatestateplanning attorney that you can completely trust. A will or a trust fund might seem costly or challenging-- something only rich individuals have.

What is the average cost of an elder law attorney?

Closing an Estate. Though you hear the term consistently, there is no such thing as Closing an Estate. The term refers to the distribution of the estate's final assets, which typically means that the Executor has run out of things to do.

A will likewise allows you to provide understanding and also direction over the handling of properties your beneficiaries will obtain. An unalterable depend on can not be customized, changed or terminated without the approval of the grantor's named recipient or beneficiaries. An estate is the cumulative amount of an individual's total assets, consisting of all home, possessions as well as other properties. Ahealthcare power of lawyer (HCPA) marks an additional individual (normally a spouse or family member) to make crucial health care decisions on your behalf in case of inability.

How do I prepare an estate plan?

Estate law attorneys earned a reported median annual salary of $64,054 in 2011. Self-employed individuals who worked in estate planning had the highest earning potential, making a yearly median wage of $95,000. Another highly paid specialization was estate law attorneys who worked for a foundation or trust.

File beneficiary types.

A fantastic family members estate attorney is one that only focuses on estate planning. Due to the fact that these specialized lawyers need to also have several years of experience and also proceeding education committed to this area, they are more probable to be completely experienced regarding the regulations in your state.

Understanding the Differences In Between a Will as well as a Trust

Essential End-of-Life Records for Senior Citizens.

He made my trust fund, as well as a lot more notably, my parents' count on a 45 mins consultation period. One stop you need to stay clear of on the estate-transfer train is the court of probate. If your strategies for transfer are not successfully laid out, this is where your beneficiaries might be spending months arranging out your estate. You could easily shed an additional 2 to 4 percent of your estate because of attorney costs and court prices.

Really feel complimentary to call us to schedule a totally free assessment if you have any type of questions concerning Closing an Estate or The Probate Process. We've seen it all, as well as this experience permits us to discuss complicated estate law and also Probate strategies clearly and briefly.

The person you name to manage your finances is called your agent or attorney-in-fact (however doesn't need to be a lawyer). A checklist to help you look after your family by making a will, power of attorney, living will, funeral plans, as well as much more. Using this system, probating a typical The golden state estate with a gross value of $500,000 would set you back $13,000 in lawful charges-- a huge amount provided the quantity of legal work entailed. The worst means to pay a probate attorney-- from the estate's perspective-- is to pay a percent of the value of the estate as the fee.

Mental deterioration and Power of Attorney: What to Do If Someone Can't or Won't Sign a POA.

If a guardian is not designated at the time of fatality, your surviving family members will have to seek assistance in a court of probate to have actually a guardian selected for your youngsters. The individual designated might not be that you would have wanted to be delegated with your kids. A designated recipient is the depend on, estate, or person called as the recipient of benefits or properties payout after a person's fatality. Estate preparation is the preparation of jobs that serve to handle a person's property base in the event of their incapacitation or death. Go over the value of wills and estate planning, including planning for a minor or grown-up with unique needs, probate https://www.feedspot.com/folder/1143587 process, as well as various other matters.

Several experts view estate preparation as an essential part of their customers' overall monetary goals, and so these consultants have one or more estate legal representatives that they'll refer their customers to depending upon each customer's specific requirements. Joint building passes to the making it through joint tenant.Life insurance as well as retired life benefits pass to their defined beneficiaries.Totten trusts ("payable-on-death" accounts) go to their defined recipients. Peter explained a complex subject really plainly, aided us to determine the best strategy to handling our estate and afterwards made it very easy for us to implement the called for records. He will be a valuable resource for years to find as well as clearly has a fantastic understanding of estate regulation that will lead to innovative solutions for us. I had a really difficult scenario with my moms and dads' estate preparation as well as potential Medicaid needs.

- The substantial loss of one's estate to the settlement of state andfederal estate taxesor stateinheritance taxesis a wonderful motivator for lots of people to place an estate strategy with each other.

- Likewise, in almost all states, you can register your supplies, bonds, or broker agent accounts to transfer to your beneficiary upon your death.

- Go over the relevance of wills and also estate preparation, including planning for a grown-up or minor with unique needs, probate procedures, as well as various other issues.

A will or count on needs to be composed in a way that is consistent with the means you have actually bequeathed the assets that pass beyond the will. And also that both people can come to be bitter towards each other (as well as you) during a lawful battle. Without the appropriate planning as well as files, court of probate might cause unintended distribution of possessions.

What is the average cost of an elder law attorney?

Closing an Estate. Though you hear the term consistently, there is no such thing as Closing an Estate. The term refers to the distribution of the estate's final assets, which typically means that the Executor has run out of things to do.

This can indicate an added one to 2 years of coursework, depending upon the topic and also the program. An additional functional method of getting additional specialization is via a mentorship and merely extra on-the-job experience. An estate law lawyer must also be trained in Attire Probate Code, which enforces limits as well as guidelines to wills as well as depends on.

How do I prepare an estate plan?

Estate law attorneys earned a reported median annual salary of $64,054 in 2011. Self-employed individuals who worked in estate planning had the highest earning potential, making a yearly median wage of $95,000. Another highly paid specialization was estate law attorneys who worked for a foundation or trust.

Speak with an Estate Preparation lawyer.

And go on as well as ask your accountant who did his/her very own personal estate strategy - the solution might be just that you're trying to find. Searching for an attorney that can aid you assembled a great estate plan might appear like an overwhelming task. However with a little assistance, you ought to be able to discover a number of certified lawyers to select from.

Marriage Vs. QTIP Trust in Estate Planning

Estate Planning: A Quick Overview of QTIP Trust vs. Marital Trust.

Nonetheless, in some cases, it could make even more feeling to have an additional family member, buddy, or a trusted advisor who is even more economically wise act as the representative. This file can provide your agent the power to transact property, become part of monetary transactions, and also make other lawful decisions as if he or she were you.

A Quick Guide to High-Net-Worth Estate Planning.

And even in those states, lawyers are not required by regulation to gather a percent charge. You can and must try to work out a hourly rate or level fee with the attorney. However several legal representatives favor the "legal cost" since it's typically extremely high in relation to the quantity of job they have to do.

It is the probate court's function to confirm and also approve a person's will. If required, the probated will, currently a legal document, can be enforced in a court-of-law. When you prepare a living trust, you wish to ensure it is done effectively so that every one of your dreams are accomplished, it fulfills all lawful needs, as well as it carries the optimum advantages.

- When required is simply as essential as creating the estate strategy in the initial location, guaranteeing that your enjoyed ones can access your important papers.

- Both QTIP trust funds and also marital depends on provide the capability to make educated decisions and also have comfort when it involves apportioning as well as shielding their estate.

It's also extremely vital to make sure that a new attorney will certainly be moral as well as credible, else the situation could worsen. It's terrible that there are such greedy, dishonest people available.

The administrator still has this power because the estate never shut; it simply ran out of points to do. Though you hear the term constantly, there is no such thing as Closing an Estate. Probate instructions never ever inform you how to "Shut the Estate," due to the fact that it never in fact occurs.

Can I create a living trust myself?

If you create a QTIP trust, then at your death no estate tax is due on the assets that go into the trust. The assets qualify for the unlimited marital deduction, which lets all property, regardless of value, pass to a surviving spouse free of estate tax.

In order to be most reliable, estate regulation attorneys have to have an extensive grasp of state and also federal tax obligation legislations, depends on, wills, home as well as property. For that reason, great interaction, teamwork and strong company abilities are vital. Financial understanding, such as exactly how to handle a balance sheet, will allow them to far better aid their clients with prudent estate preparation. An estate law attorney have to remain up-to-date with the ever-changing tax regulations that can affect the worth of clients' estates. A lawyer might also suggest a living trust fund, which will let your family prevent the expenditure and delay of court of probate procedures after your death.